The amortization must be high sufficient to ensure that the mortgage is repaid in full throughout the agreed time period without exceeding the financial burden. The amortization period ought to ideally be between 5 and 15 years, depending on the kind of investment and individual monetary targets. Let’s assume you’re taking out a loan of 10,000 euros with an annual interest rate of 5% and a time period of 5 years. With straight-line amortization, also identified as equal or fixed amortization, the debt or worth of an asset is repaid or depreciated in equal quantities over the whole time period.

Evaluate each options to make the best choice on your price range and targets. So on a $250,000 mortgage, you may pay $5,000 to $12,500 in various closing charges. Lenders are required to provide a detailed estimate of all costs on the Mortgage Estimate type whenever you apply. It’s how you https://www.simple-accounting.org/ steadily write off the initial cost of those assets over their useful life. Nonetheless, for some, these mortgage funds happen over an extended period — it can be a really slow and drawn-out course of.

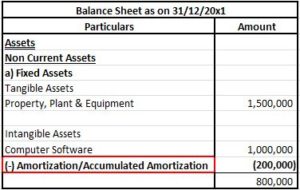

Key Distinctions: Amortization Vs Depreciation

Debt financing costs for these devices are amortized beneath ASC 835 with the curiosity method. These are several types of expenses paid to lawmakers, regulator entities, auditors, and investment banks to complete the debt-issuing course of. Let us talk about what are financing prices and how they should be amortized over the period of the debt instrument. Your lender should present an amortization schedule exhibiting how much of each payment will comprise curiosity versus principal. The principal amount paid within the period is utilized to the excellent loan balance. Subsequently, the current loan balance, minus the principal quantity paid within the interval, leads to the new excellent loan steadiness, which is used to calculate the curiosity for the subsequent interval.

One of the worst mistakes made by readers of monetary reports is giving worth to all intangible belongings, particularly financing costs. This explicit asset had no real value in any type of liquidation or enterprise valuation functions. In addition, the amount reported on the earnings statement is a non-cash expense much like depreciation. Closing prices are the various charges charged by lenders and third parties to process and close a mortgage mortgage.

Amortization is the affirmation that such property maintain worth in an organization and must be monitored and accounted for. To precisely report the periodic payment of an intangible asset, make two entries within the company’s books. You can use this accounting function to assist cover your operating costs over time while still having the ability to make the most of and generate income off the asset you’re paying off. Corporations must account for amortization as stipulated in main accounting standards. A good example of how amortization can impression a company’s financials in an enormous way is the purchase of Time Warner in 2000 by AOL through the dot-com bubble.

Amortization, the method of spreading out a loan right into a sequence of fixed payments over time, plays a pivotal position in financial planning. It not solely impacts how individuals and companies budget and plan for the future but additionally impacts the overall monetary health of an economy. From the perspective of a borrower, amortization provides a clear roadmap for mortgage repayment, allowing for constant budgeting and monetary stability.

![]()

Do I Pay More Curiosity Initially Of My Loan Or The End?

- Equally, if the borrower cannot renew the revolving facility and there are unamortized costs, they are going to be included in the earnings upon the debt repayment date.

- At the top of the time period, the remaining steadiness is due as a final compensation, which is usually large—at least double the quantity of earlier funds.

- When a business acquires a loan there are usually closing costs involved.

- You would want to debit Loss on early extinguishment of debt by 1.2mm plus the penalty and authorized prices of $300k.

Not all costs at closing deal directly with financing of the purchase value, however most do. The accountant separates all the prices into 4 distinct teams; one is financing. The precise mortgage proceeds are recorded as a long-term liability within the liabilities part of the stability sheet. Prior to April 2015, financing charges were treated as a long-term asset and amortized over the term of the loan, using both the straight-line or interest methodology (“deferred financing fees”). Take time to run the numbers and decide if the curiosity savings outweigh paying fees in cash for your situation. Many first time residence patrons select to amortize costs to lower money needed at closing.

The two prepaid objects are merely regular (protection and ongoing tax) prices which would possibly be superior by the borrower and recorded as pay as you go expenses within the current assets section of the balance sheet. Typically the stamp price is merely a tax and may be written off as a direct expense. The balance of those prices all relate to the precise loan processing and are accumulated as one summed amount called mortgage financing prices. Many discover utilizing an online amortization calculator extra handy, as these instruments automatically generate the monthly fee and provide an amortization schedule. This schedule breaks down every payment into curiosity and principal parts, exhibiting how the loan steadiness decreases over time.

As a result, a revolving credit permits you to pay off and borrow once more as much as your credit score restrict indefinitely. PwC refers again to the US member firm or one of its subsidiaries or affiliates, and will typically check with the PwC community. This content material is for common information purposes only, and shouldn’t be used as an various selection to session with professional advisors. You would need to debit Loss on early extinguishment of debt by 1.2mm plus the penalty and legal prices of $300k. By the final fee, those numbers flip, with virtually all of the $990 going to the principal. Tangible property are things like tools, furniture, vehicles and property.

When the observe is issued and the mortgage costs are incurred, the corporate will debit a liability account corresponding to Deferred Debt Issuance Costs for $120,000. This account balance is presented together with the $4,000,000 credit stability in Notes Payable. The outcome will be an initial internet long-term legal responsibility of $3,880,00 and a net cash increase of $3,880,000. Every month the company will amortize the debt issue costs by crediting Deferred Debt Problem Costs for $2,000 and debiting Curiosity Expense for $2,000. Most loans have a definitive period of time corresponding to 84 months (7 years), a hundred and twenty months (10 years) and so on.

Amortization displays the reality that intangible property have a value that have to be monitored and adjusted over time. The amortization idea is topic to classifications and estimates that must be studied closely by a firm’s accountants and auditors, who must log out on monetary statements. If somebody takes a $200,000 mortgage mortgage for 20 years at a 5% annual interest rate, they make a month-to-month fee of $1,073.